Riding the Storm: Navigating Turbulence in the World of Wealth (WoW) Management

March 28, 2024

The wealth management (WM) sector is facing unprecedented turbulence amidst global economic volatility. This volatility has led to significant investment outflows and a surge in cash deposits, coupled with a decline in lending activity. As consumer spending patterns become increasingly erratic, wealth management firms are confronted with new challenges, including strained revenues and soaring operational costs, resulting in diminished profits. In response to these challenges, leading wealth management firms are pivoting to fortify their value propositions, enhance productivity, and uncover new avenues for sustainable growth. They are reassessing their capabilities, bolstering their workforce, and exploring untapped client segments.

Looking ahead, a paradigm shift in mindset and business models is crucial to navigating the evolving landscape. Despite the uncertainties, the wealth management sector holds enduring potential, fueled by the continued growth of household and entrepreneurial wealth worldwide. Wealth management firms can position themselves for success by charting a clear technology roadmap, leveraging ecosystem integration and customer insights, and refining risk-assessment processes. Embracing digital transformation while preserving the value of personal relationships is key to thriving in this dynamic landscape.

So, is your organization prepared to embrace the winds of change and lead the charge into the future of wealth management?

This article delves into the signals of change, potential business models, and essential capabilities for wealth managers to thrive amidst turbulence and uncertainty covered under:

- Disruptive Trends Reshaping WM Industry Dynamics

- Future business models: Three ways to play

- Meeting Customer Expectations Through Digital Innovation

- Building a Futuristic Foundation: A Three-Stage Approach in Wealth Management

- Conclusion: The Way Forward

Disruptive Trends Reshaping WM Industry Dynamics

The wealth management industry is being reshaped by a variety of disruptive trends, including technological advancements, changing client expectations, demographic shifts, regulatory changes, and evolving business models. Technology is enabling new forms of service delivery and enhancing client engagement, while changing client expectations are driving demand for more personalized and advisory-focused services. A massive intergenerational wealth transfer from baby boomers to millennials and Gen Z is prompting wealth managers to adapt their strategies, while the industry is also facing an increasingly complex regulatory environment. New business models are emerging in response to industry challenges and opportunities, including the integration of wealth management with broader financial services and the exploration of partnerships between traditional firms and fintechs. Private markets and digital assets are also gaining interest, and wealth management firms are focusing on cost transformation and efficiency improvements by offering innovative services such as robo-advisers, price-comparison tools, fund distribution, micro-investing, investment-related data, ethical investing options, peer-to-peer networking platforms, and asset marketplaces for buying and selling investments.

Social media platforms and online retailers like Alibaba and Amazon are also entering the wealth management arena, expanding the range of options available to investors. For instance, Amazon has invested in Indian fintech startup Smallcase Technologies, demonstrating its interest in this sector.

Fintech disruptors are appealing due to their convenient and instant access to investment tools and services. These disruptors cater to mass-market segments and emerging affluent clients, particularly tech-savvy millennials. Traditional wealth management firms are responding by forming partnerships and alliances with fintech players. Examples include Edelweiss Global Wealth Management’s partnership with Salesforce and online banks like Marcus expanding into wealth management. Partnerships with digital wealth management platforms and robo-advisors are also being pursued to diversify service offerings and attract a broader customer base.

Future business models: Three ways to play

The future of wealth management is characterized by three distinct business models designed to meet clients’ diverse needs across various segments. These models transcend traditional wealth levels and instead focus on client preferences and objectives.

1. Financial Well-being Provider:

Targeting retail banking and affluent customers, this model focuses on digitally enabled solutions for achieving financial goals. It emphasizes operational efficiency and agility, particularly in regions like Asia Pacific where digital-savvy customers demand advanced platforms.

Bank of America‘s Merrill Lynch launched Merrill Advisor Match, a digital platform that leverages data analytics and personalized algorithms to connect affluent clients with advisors. More than 5,000 Merrill relationship managers have been trained to use the platform, which gathers data on investor attitudes, behaviors, and life goals. 43% of affluent individuals feel their investments do not align with their life goals. Merrill Advisor Match excels in connecting clients and advisors based on various dimensions, leading to more personalized engagement.

2. Domestic Wealth Manager:

Catering to sophisticated ultra-high-net-worth clients, this model offers personalized, face-to-face engagement supported by digital capabilities. Trusted local brands and highly personalized service are crucial, fostering enduring partnerships with multi-generational families.

Volt, a Zurich-based digital investment platform launched in 2019, aims to bridge the gap between private banking-level service and digital accessibility. It provides personalized face-to-face engagement, curated portfolios, and exclusive benefits to affluent clients, offering them access to digital investment services typically reserved for high-net-worth individuals. Volt sets itself apart by providing ESG certification across its entire basic portfolio, ensuring sustainability in all investments.

3. Global Investment Expert:

Serving an exclusive clientele with established brands and seamless global reach, this model provides specialized, price-competitive offerings across asset classes and complex capital market structures. Success in this segment requires global capabilities, knowledge, and operations to serve clients with global financial interests seamlessly.

The entry of Swiss banking giant UBS into China’s affluent market with its WE.UBS digital platform in October 2022 signaled a significant expansion in wealth management services. Designed to cater to the needs of affluent clients, WE.UBS represents a convergence of cutting-edge technology and personalized financial solutions. The quick-to-onboard, AI-driven platform offers local and global investment products, investor education, and 24-hour tracking based on market developments.

These business models complement diverse customer segments, ranging from family offices catering to high-net-worth individuals and affluent families to retail wealth management platforms offering accessible investment options and financial planning tools for a broader demographic.

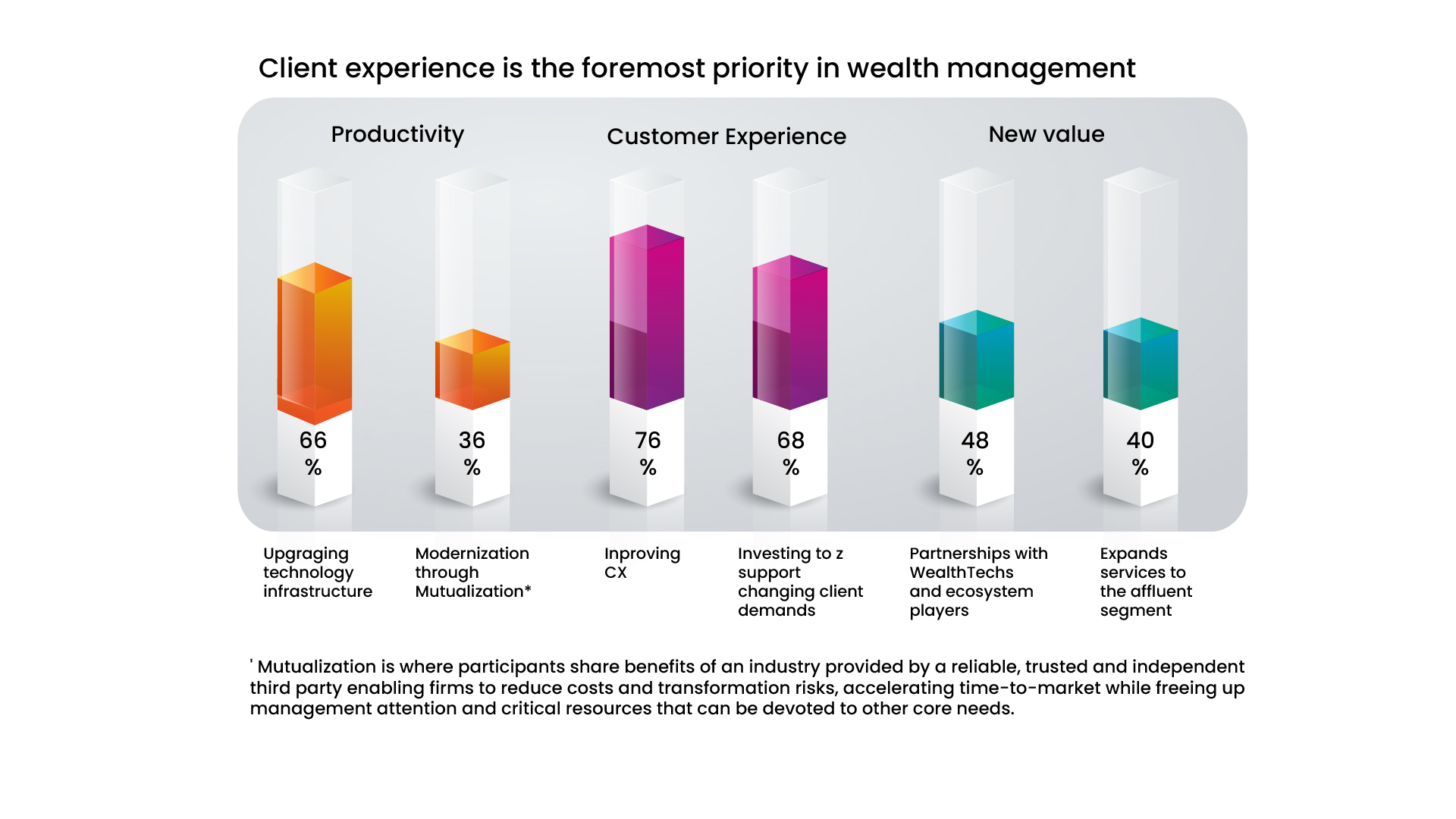

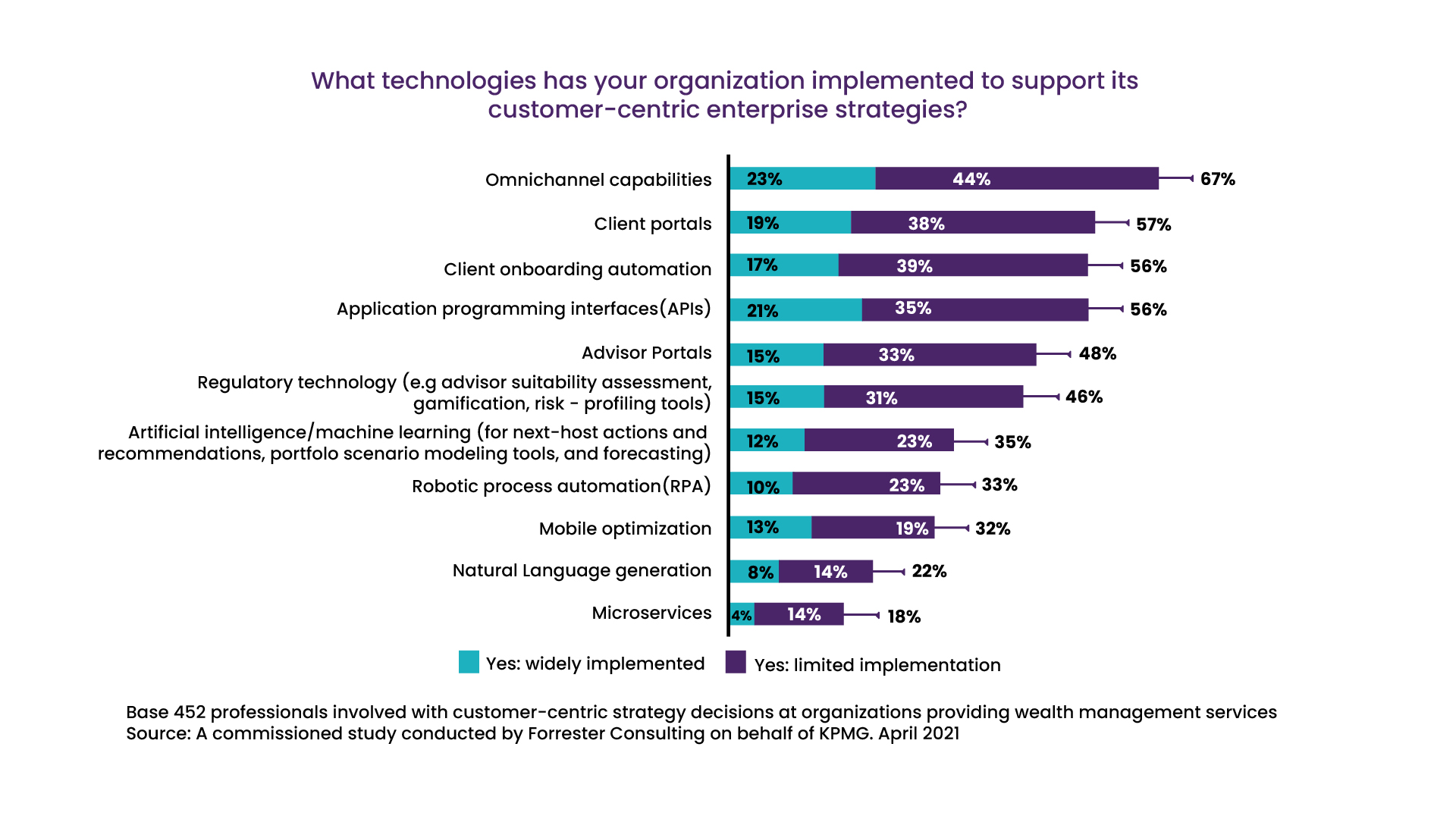

Meeting Customer Expectations Through Digital Innovation

Customers anticipate highly personalized, digital-first engagement from their financial service providers, a trend accelerated by COVID-19 and the rapid proliferation of innovative wealth and investment apps and platforms. This entails ensuring secure, seamless connections, offering self-service capabilities complemented by advisor assistance, and maintaining high levels of transparency across digital channels. Customers, many of them tech-savvy digital natives, seek products and services tailored to their growing investment needs and preferences, spanning savings, pensions financial planning, and simple investment products.

Wealth management firms are continuously innovating to meet the evolving needs of sophisticated clientele. These innovative solutions aim to provide personalized, digital-first experiences while addressing complex investment demands. Here are some examples of how wealth management firms are bringing innovative products to the market:

1. Robo-Advisors and AI-driven Investment Strategies:

Wealth management firms are leveraging artificial intelligence (AI) and machine learning (ML) algorithms to offer robo-advisor platforms. These platforms analyze client data, risk preferences, and market trends to provide tailored investment advice and portfolio management. Wealthfront and Betterment offer automated investment platforms that utilize algorithms and technology to provide personalized financial advice and portfolio management at a fraction of the cost of traditional advisors. By leveraging advanced algorithms and data-driven insights, these platforms can efficiently allocate investments, rebalance portfolios, and optimize tax strategies to help individuals achieve their financial goals.

2. Alternative Investments and Private Market Access:

Firms are expanding their product offerings to include alternative investments such as private equity, venture capital, and real estate. Through innovative platforms like iCapital Network and CAIS, clients gain access to exclusive investment opportunities typically reserved for institutional investors. These platforms streamline the investment process and provide diversified portfolios across different asset classes.

3. Digital Wealth Platforms and Mobile Apps:

The pandemic has increased the focus on health and well-being, beyond pure financial returns. Wealth managers, pension and insurance companies, and even virtual/digital banks are all branching into lifestyle products, in some cases giving premiums to clients with healthier lives. John Hancock, a life insurance company, offers the Vitality program, which rewards policyholders for engaging in healthy activities, such as exercising, eating well, and getting regular check-ups. Participants earn points that can be redeemed for premium discounts, gift cards, and travel rewards, encouraging them to adopt healthier habits. Wealth management firms are investing in digital wealth platforms and mobile apps to enhance client engagement and accessibility. These platforms offer features like goal-based financial planning, budgeting tools, and real-time portfolio tracking. Examples include Personal Capital and Wealthfront, which provide comprehensive financial management solutions accessible through desktop and mobile devices.

4. Blockchain and Cryptocurrency Services:

The emergence of digital assets, such as cryptocurrencies and blockchain-based tokens, has introduced a new frontier in wealth management. While digital assets are known for their volatility and regulatory uncertainty, they offer diversification benefits and exposure to innovative technologies shaping the future of finance. Recognizing the potential of blockchain technology and cryptocurrencies, some wealth management firms are offering services related to digital assets. For instance, firms like Coinbase and Gemini provide secure platforms for buying, selling, and storing cryptocurrencies, catering to clients interested in diversifying their investment portfolios with digital assets. Merrill Lynch is providing access to Bitcoin ETFs for its ultra-high-net-worth customers with assets of $10 million or more, emphasizing the tailored approach to catering to the investment needs of its wealthiest clients. Bank of America (Merrill Lynch) and Wells Fargo have made Spot Bitcoin ETFs available to their brokerage clients. This move signals a significant step towards mainstream adoption of cryptocurrency investment products by traditional financial service firms. Not only that the large institutions like JP Morgan Chase, Fidelity and UBS are making cryptocurrency funds available to all their wealth management clients. DEF Crypto Advisors offers bespoke advisory services for clients interested in incorporating digital assets into their investment portfolios. Leveraging deep expertise in blockchain technology and cryptocurrency markets.

5. ESG and Sustainable Investing Options:

With growing client interest in environmental, social, and governance (ESG) investing, wealth management firms are incorporating ESG criteria into their investment strategies. Firms like Morgan Stanley and UBS offer ESG-focused investment products and portfolios that align with clients’ values and sustainability goals. These offerings enable clients to invest in companies and assets that prioritize responsible business practices and positive social impact.

Overall, these innovative wealth management products empower sophisticated clientele to achieve their financial goals efficiently while adapting to changing market dynamics and investor preferences.

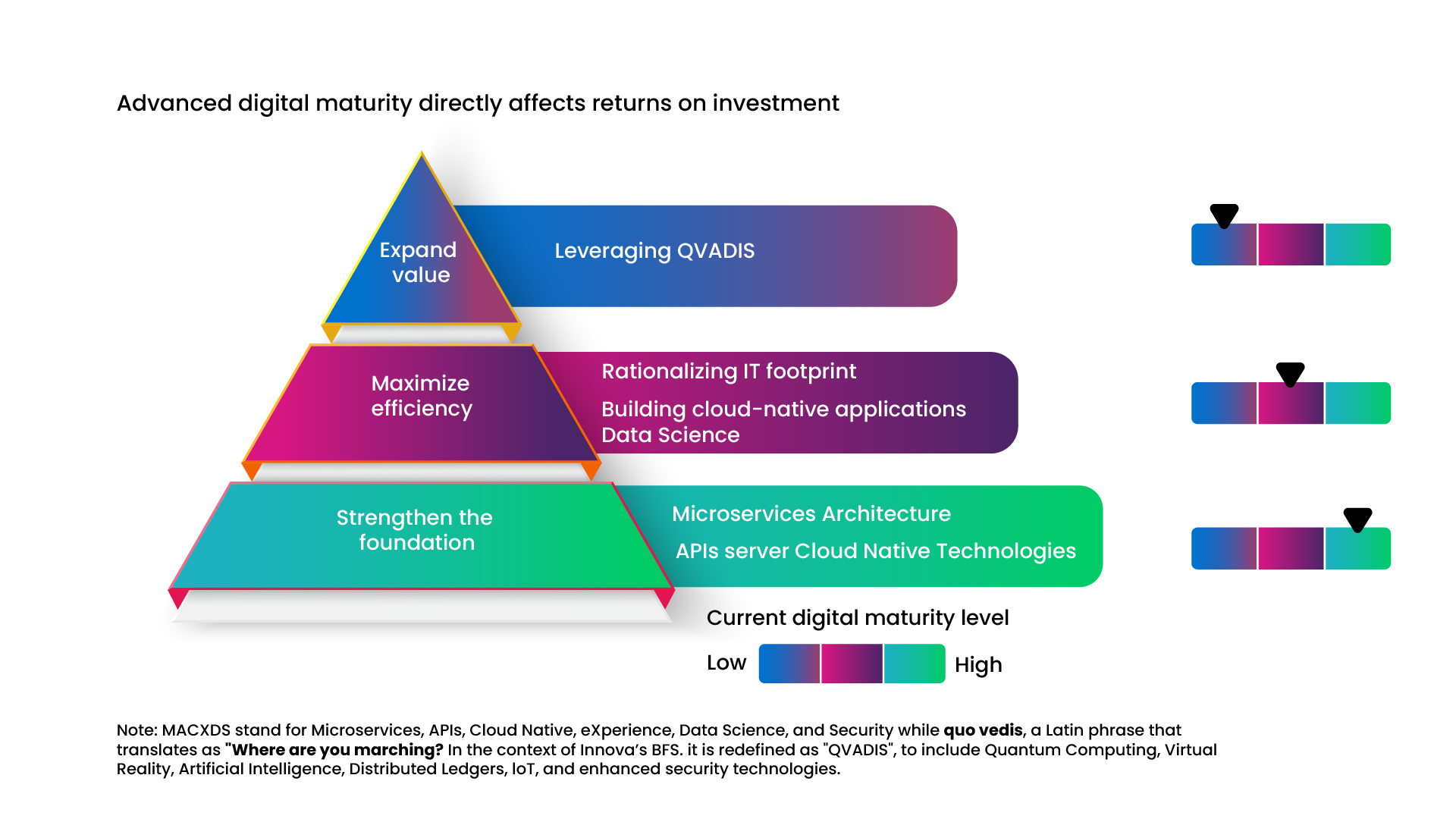

Building a Futuristic Foundation: A Three-Stage Approach in Wealth Management

In the rapidly evolving landscape of wealth management, firms are increasingly turning to advanced technologies to enhance their operations, improve client experiences, and stay ahead of the competition. Leveraging a combination of MACXDS (Microservices, APIs, Cloud Native, eXperience, Data Science, and Security) and QVADIS (Quantum Computing, Virtual Reality, Artificial Intelligence, Distributed Ledgers, IoT, and enhanced security) technologies, wealth management firms are adopting a three-stage approach to build a strong foundation, maximize efficiency, and expand value.

Stage 1: Building a Strong Foundation:

The first stage of the transformation journey involves building a strong foundation for digital innovation. Wealth management firms are adopting Microservices architecture to enhance agility and scalability, breaking down complex systems into modular, independently deployable services. APIs serve as the backbone of interoperability, enabling seamless connectivity between disparate systems and facilitating data exchange among financial institutions and third-party providers. Cloud Native technologies leverage cloud computing infrastructure to enhance flexibility, scalability, and cost-effectiveness, empowering firms to innovate and scale operations while ensuring robust security and compliance measures.

Stage 2: Maximizing Efficiency

Once the foundation is in place, wealth management firms focus on maximizing efficiency in their operations. Legacy systems are decommissioned in phases to rationalize IT footprints, leveraging increasing cloud maturity. AI-driven technologies are deployed to automate routine tasks, optimize portfolio performance, and deliver personalized recommendations in real-time. Data Science plays a pivotal role in unlocking insights from vast datasets, enabling predictive analytics, personalized recommendations, and risk modeling to inform investment decisions and enhance portfolio performance. Enhanced security measures safeguard sensitive financial information and ensure regulatory compliance, mitigating cyber threats and protecting client assets.

Stage 3: Expanding Value

In the final stage of the transformation journey, wealth management firms focus on expanding value through ecosystem orchestration and the adoption of QVADIS technologies. Quantum Computing promises exponential advancements in data processing speed and computational power, enabling complex risk modeling, optimization algorithms, and portfolio simulations. Virtual Reality platforms offer immersive experiences for client engagement, enabling virtual meetings, interactive portfolio visualization, and tours of investment properties. Distributed Ledger Technologies facilitate transparent and secure transactions, streamline back-office operations, and enable fractional ownership of assets through smart contracts. IoT introduces new avenues for data collection and analysis, leveraging interconnected devices and sensors to monitor asset performance, assess risk factors, and personalize financial products and services based on real-time insights. Enhanced security measures remain paramount in safeguarding sensitive financial data and ensuring regulatory compliance, with robust encryption, biometric authentication, and decentralized identity solutions.

Conclusion: The Way Forward

The wealth management sector has enduring growth potential due to various factors like household wealth, retirement savings, and intergenerational wealth transfer. The competitive landscape is changing with new entrants, technology, and regulatory changes. New customer expectations around technology and easy access to data, and ever-higher demands for a seamless and simplified customer experience are raising the bar high for wealth management firms. With the added complexity of the regulatory environment, firms may face increased cost structures, while finding revenue growth at risk. As a result, wealth managers must engage in a deep transformation of their business. Innova helps clients transform their wealth management business to:

- Embrace a new wealth business model

- Unify the wealth client and banker experience through Unified Wealth Analytics Platform

- Unleash an evolved Advisor Workstation with intelligent and augmented relationship management capabilities

Let us co-create in your journey to next-gen Wealth Management Advisor.

Key Contributor: Maitri Dwivedi, Lead – Content/ Research & Sales Enablement