B2B Payments: Unlocking A Trillion-Dollar Opportunity for Banking & Financial Sector

October 31, 2023

Introduction: The changing landscape of B2B payments

Fuelled by rapid technological transformation and digitalization, the Fourth Industrial Revolution (4I) has already transformed the way we conduct business. In an era characterized by unprecedented global connectivity, B2B payments have emerged as the vanguard of a financial revolution, reshaping the landscape of international commerce. As businesses traverse borders and forge collaborations on an unprecedented scale, the significance of seamless, efficient, and secure payment mechanisms has never been more pronounced.

In this dynamic age of globalization, where economic interactions span continents and time zones, the question quo vadis, a Latin phrase that translates as “Where are you marching”? In the context of Innova’s BFS, it is redefined as “QVADIS”, a thought-provoking metaphor to question the future trends, challenges, and opportunities about the industry’s trajectory. QVADIS embraces emerging technologies – Quantum Computing, Virtual Reality, Artificial Intelligence, Distributed Ledger, IoT, and Security – paving the way forward as pioneers for more efficient, secure, and customer-centric financial services. B2B payments are driving a paradigm shift and distributed ledger technology, commonly known as blockchain, is at the forefront of this revolution offering a decentralized and secure way to record and verify transactions across a network of computers.

This article explores the pivotal role of B2B payments in shaping a future where financial transactions are executed with unparalleled speed, transparency, and adaptability. To deliver justice to the topic, we have examined technologies, trends, strategies and areas of growth and revenue generation separately under the below subheads:

- Redefining commerce with the trends of tomorrow

- Factors affecting B2B Payments and their redressal

- Areas of growth and revenue generation

- Evolving regulatory requirements and compliance to overcome resistance

- Conclusion: B2B Payments are a cornerstone of modern commerce

- How Innova can help in your digital transformation journey?

Redefining commerce with the trends of tomorrow

With $2.3 Trillion in Revenue, Corporate & Commercial Banking (CBB) makes up nearly 40% of total global banking revenue. Corporate and commercial clients are no longer satisfied with the traditional banking and loan systems. They want tailor-made solutions pulled from a broader range of services—transactional, commission-based services like digital, instant payments and out-of-banking capabilities such as spend analytics and detailed liquidity and cash forecasts.

Clients also expect banks to have the capabilities and industry-specific expertise to work with them across their global supply chains and help them tackle new challenges, including decarbonization.

- The B2B Payments Transaction market size was valued at US$ 868.02 million in 2020 and is expected to hit US$ 70 billion by 2030 with a CAGR of 10.7% from 2021 to 2030. (Precedence Research, 2021)

- The global B2B payments market size is expected to grow from $1,043.16 billion in 2022 to $1,136.60 billion in 2023 at a compound annual growth rate (CAGR) of 9.0%. (The Business Research Company, 2023)

- Through the first half of 2022, B2B volume on the ACH Network was 2.9 billion payments, up 16% from the first half of 2021. (AFP, 2022)

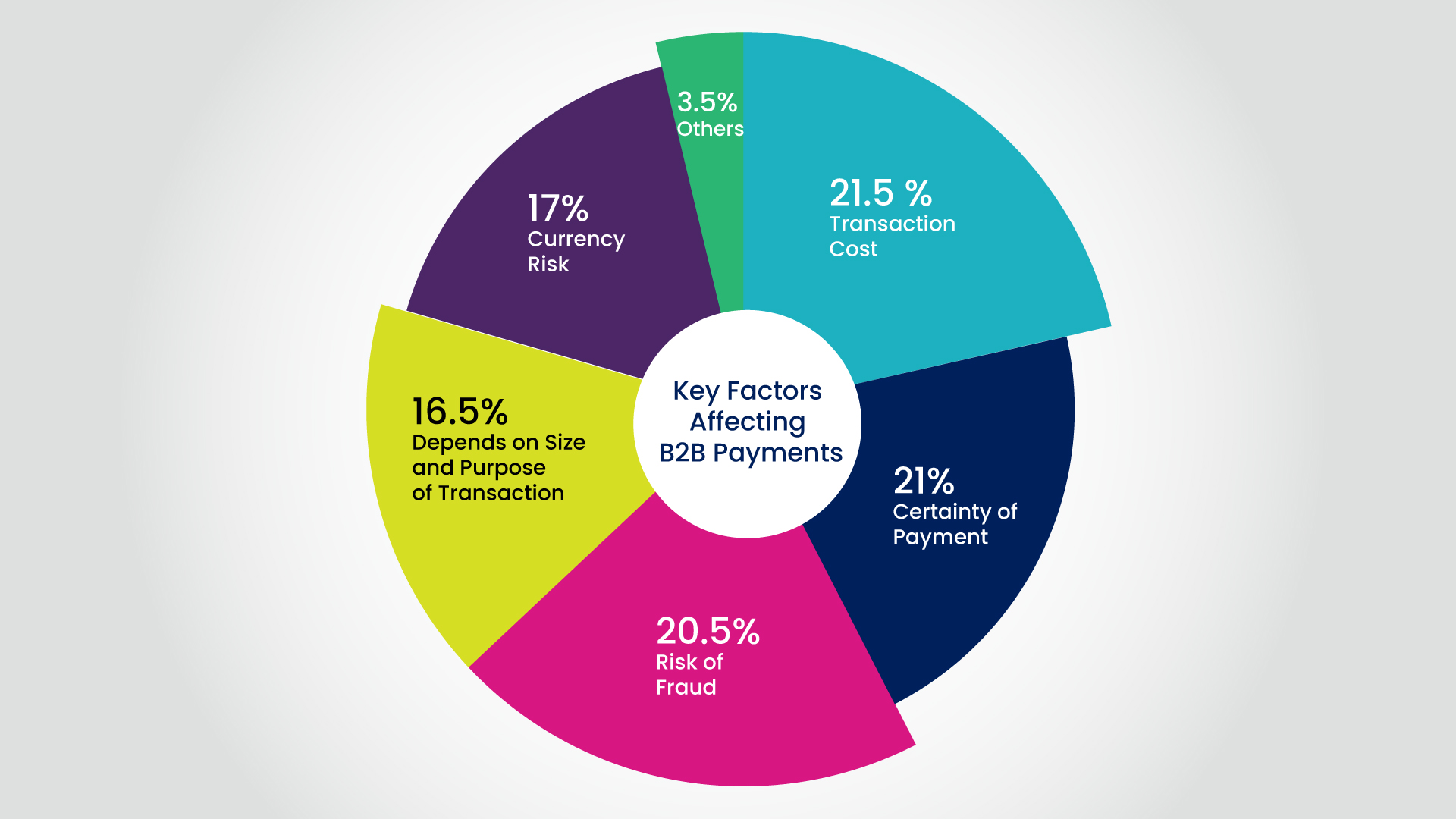

Factors affecting B2B Payments and their redressal

Financial professionals weigh various factors when selecting a payment method due to their direct impact on the efficiency, transparency, and trustworthiness. Timely and secure payments are the lifeblood of businesses, and in the context of trade (cross border and domestic), they become even more critical. Factors such as speed of transaction, currency conversion costs, and compliance with various financial regulations significantly influence the success of a business. In essence, the considerations surrounding B2B payments are paramount for ensuring smooth and mutually beneficial transactions, ultimately driving the growth and sustainability of global commerce.

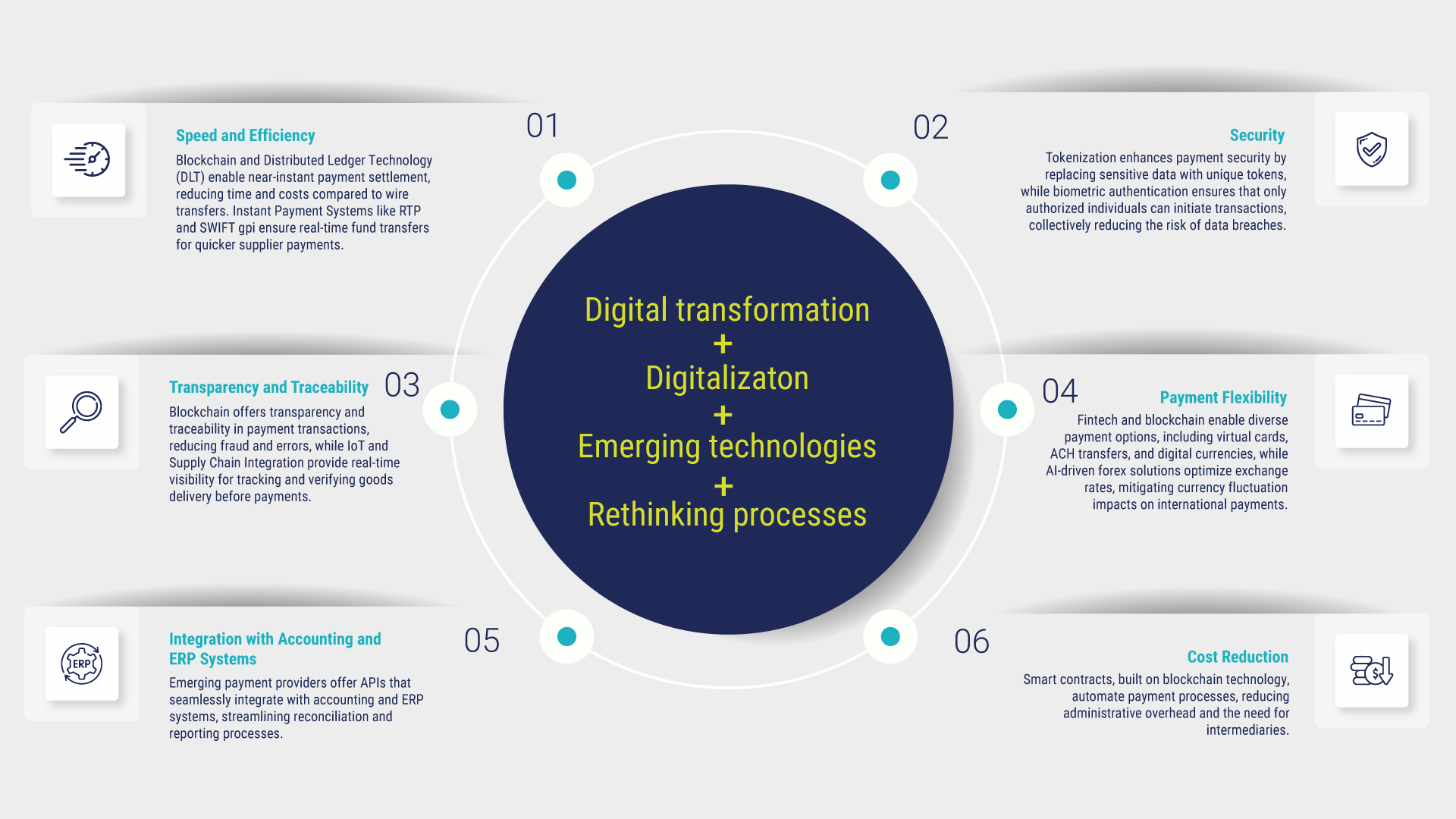

Emerging technologies are addressing payment factors for businesses by offering innovative solutions when choosing payment methods. These technologies contribute to making B2B payments more efficient, secure, and cost-effective:

- Speed and Efficiency: Blockchain and Distributed Ledger Technology (DLT) allow for near-instant settlement of payments, reducing the time and cost associated with traditional methods like wire transfers. On the other hand, Instant Payment Systems, such as RTP (Real-Time Payments) and SWIFT gpi, ensure that funds are transferred in real-time, enabling faster supplier payments.

- Security: Tokenization of payment data adds an extra layer of security by replacing sensitive payment information with unique tokens, reducing the risk of data breaches. Other emerging technologies like biometric authentication (fingerprint, facial recognition) enhance payment security by ensuring that only authorized personnel can initiate transactions.

- Transparency and Traceability: The transparent and immutable nature of blockchain ensures that payment transactions can be traced and audited easily, reducing the risk of fraud and errors. IoT and Supply Chain Integration provide real-time visibility into the supply chain, enabling businesses to track and verify the delivery of goods before making payments.

- Payments Flexibility: Fintech companies and emerging platforms are using blockchain to facilitate Multi-Channel Payment Options, including virtual cards, ACH transfers, , and digital currencies, giving businesses flexibility in choosing the most suitable payment method. AI-driven forex solutions help businesses optimize currency exchange rates, reducing the impact of currency fluctuations on international payments.

- Integration with Accounting and ERP Systems: Emerging payment providers offer APIs that seamlessly integrate with accounting and ERP systems, streamlining reconciliation and reporting processes.

- Cost Reduction: Smart contracts, built on blockchain technology, automate payment processes, reducing administrative overhead and the need for intermediaries.

Areas of growth and revenue generation:

B2B payment solutions for SMBs & mid-market companies: B2B payment solutions tailored for Small and Medium-sized Businesses (SMBs) and mid-market companies are increasingly becoming essential tools in streamlining financial operations. By leveraging technology, these payment solutions offer features such as automated invoicing, digital payment processing, and real-time tracking, which help optimize cash flow and reduce administrative burdens. Additionally, they often integrate seamlessly with existing accounting and ERP systems, enhancing operational efficiency.

Virtual cards, commercial cards & spend / expense management platforms: Virtual cards and commercial cards, along with spend and expense management platforms, form a dynamic ecosystem in modern financial transactions.

Virtual cards, being digital representations of physical credit cards, offer enhanced security and control for online transactions. They are particularly useful for one-time or limited-use transactions, providing a layer of protection against fraud and unauthorized charges.

Commercial cards, on the other hand, are specialized credit cards issued to businesses for managing expenses. They streamline the procurement process, allowing for centralized control over spending, detailed reporting, and often come with customizable spending limits for employees.

Complementing virtual cards and commercial cards are expense management platforms provide businesses with powerful tools to track, analyze, and control their spending. Additionally, businesses can automate the expense reporting process, allowing employees to easily submit expenses while enabling management to review and approve them efficiently. They offer robust reporting features, generate valuable insights into spending patterns and help businesses make informed financial decisions.

Payment solutions for B2B marketplace: Payment solutions are facilitating seamless and secure transactions for B2B marketplaces serving as the backbone of modern commerce. They are tailored to meet the unique needs of B2B transactions, offering features like bulk payments, customizable invoicing, and robust fraud detection. Furthermore, often integrated with various payment methods, including virtual cards, ACH transfers, and virtual wallets, provides flexibility for both buyers and sellers. Additionally, equipped with advanced reporting and analytics tools, they provide businesses with valuable insights into their transaction data.

Vertically focused payment processors: Vertically focused processors concentrate on serving a particular vertical or industry segment, such as healthcare, hospitality, or e-commerce. By honing in on the unique needs and regulatory requirements of a specific sector, these processors can offer tailored solutions that address industry-specific challenges. It offers features like integrated point-of-sale systems, custom reporting tools and compliance with sector-specific standards. This targeted approach allows businesses within a particular industry to streamline their payment processes, enhance efficiency, and ensure compliance with industry-specific regulations, ultimately leading to a more seamless and secure financial transaction experience.

Cross-border payments: Financial transactions between individuals, businesses, and financial institutions located in different countries play a pivotal role in the global economy. Such payments can introduce complexities related to exchange rates and currency conversion fees as it involves different currencies. To tackle the friction pertaining cross-border payments, various technologies and systems have been developed, including SWIFT (Society for Worldwide Interbank Financial Telecommunication), blockchain, and fintech platforms. Additionally, regulatory bodies and international organizations are working towards establishing standards and frameworks governing cross-border payments to streamline the process, reduce costs, and enhance transparency in cross-border transactions.

Amidst the competition to catch the bigger pie in the market share, both startups and legacy players are innovating their solutions and service offerings. Card Networks like Visa and Mastercard, Big Tech companies like Stripe and Adyen and banks like Citibank and Capital One are already ramping up their B2B payment offerings, offering significant value to both buyers and sellers in the process.

Evolving regulatory requirements and compliance to overcome resistance

As international trade and domestic business avenues continue to grow, it is critical for global institutions to develop solutions that address frictions in B2B payments. Adherence to evolving regulatory requirements remains a paramount focus in the realm of B2B payments. In addition to GDPR and PSD2 in Europe, regulatory compliance in the B2B payments landscape extends to various regulations and data protection laws around the world. These include laws like the Personal Information Protection Law (PIPL) in China, the Personal Data Protection Act (PDPA) in Singapore. Adhering to these regulations ensures the secure handling of sensitive information and reinforces trust in B2B transactions across international borders.

Furthermore, the use of the latest ISO 20022 payment messaging standards is enabling end-to-end international payments tracking feature which helps businesses track payments and fees across intermediary banks. However, as the US prepares to launch its domestic real-time payments initiative, FedNow, like the EU’s Single Euro Payments Area (SEPA), business demand for more innovation in international payments is still outpacing the global regulatory framework which supports complex processing of compliance checks. Businesses are also expecting elevated international payment experiences similar to enhanced consumer payment methods, such as mobile wallets.

Conclusion: B2B Payments are a cornerstone of modern commerce

B2B payments have evolved from traditional paper-based processes to a seamless and highly efficient ecosystem representing a pivotal shift in how businesses operate and generate revenue. With the integration of advanced technologies, such as AI, Distributed Ledger, and IoT, coupled with the adoption of innovative payment solutions, the B2B ecosystem is poised for transformation. Additionally, the emphasis on regulatory compliance and data protection laws to ensure utmost care in handling sensitive financial information is transforming the way businesses transact with one another in the domestic as well as international markets. This shift not only streamlines operations but also opens up new avenues for revenue generation – allowing financial institutions to redefine their business model by collaborating with fintech platforms and forging stronger partnerships to drive positive change in the broader economic and social landscape.

As the B2B landscape continues to evolve, adaptability and innovation will be key in seizing these new revenue opportunities by tapping into previously untapped markets and staying competitive in an ever-changing market.

How Innova can help in your digital transformation journey?

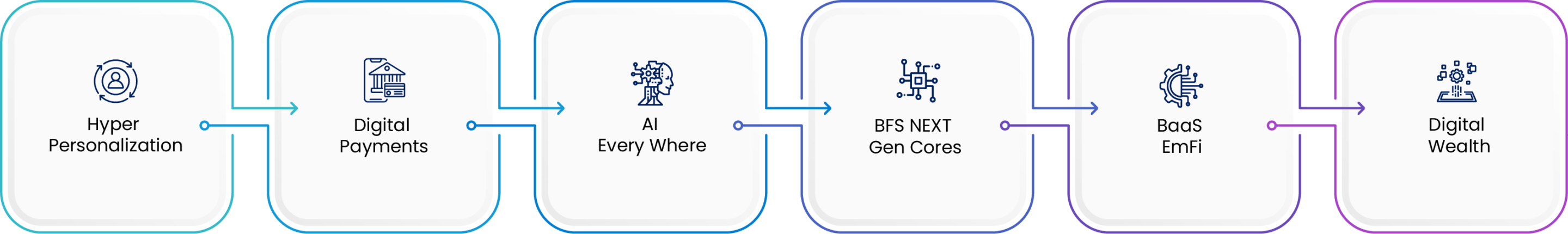

Innova’s modern technology solutions help banks and financial institutions streamline their digital transformation and enhance customer experiences to stay ahead of the competition. Our digital solutions are rooted in the notion that every challenge has a scalable solution waiting to be unlocked. We boldly innovate, design, and customize solutions, catering to client’s needs using our Six themes of innovation:

At Innova, we recognise the need of using innovation and emerging technologies such as Microservices, APIs, Cloud Native, eXperience, Data Science, and Security (MACXDS) as we embrace the digital revolution to develop experiences that are both seamless and engaging. Our Innovators with expertise in digital technologies are helping organizations to stay ahead of the curve on digital maturity and redefine the banking and financial services landscape.

Connect with us today to explore the tailored modern technology solutions best suited for your organization, unlocking new avenues of revenue growth within this Trillion Dollar Opportunity.

Key Contributor: Maitri Dwivedi – Lead, Content/ Research & Sales Enablement