Table of Contents

1

Introduction

2

COVID-19 and its Impact on Digital Business Strategy

3

Digital Transformation and Long Tail Revenue

5

Conclusion

6

Contributor

Introduction

Introduction

For the last seven or so years, we have been hearing about a combination of business drivers that keep motivating established businesses to embark on various forms of digital transformation efforts. Efforts that enable traditional brick-and-mortar businesses to go off on offense to expand their reach and/or look inward in defense to protect their turf.

That enemy being the band of respective digital predators that have been busy disrupting their markets with newer “as-a-service” digital offerings.

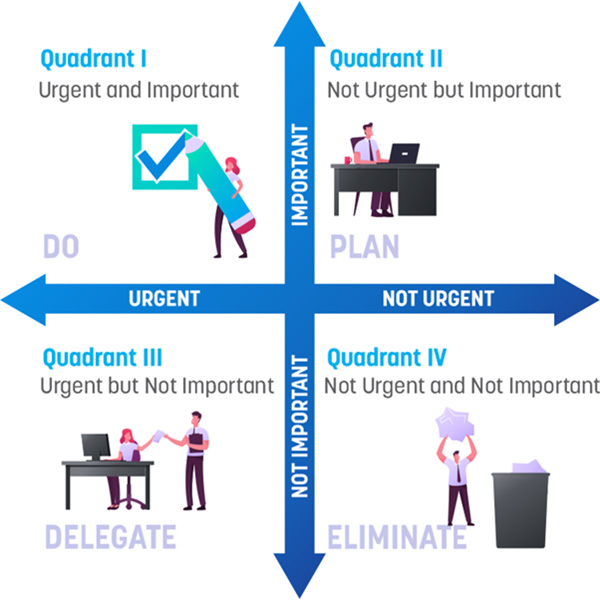

But then COVID-19 came along, and what we now observe is that it has brought with it a heightened sense of urgency to digital transformation, moving it from a Quadrant#2 activity to one of Quadrant#1, as in something that is ‘important’ and ‘urgent’.

COVID-19 and its Impact on Digital Business Strategy

COVID-19 and its Impact on Digital Business Strategy

COVID-19 is making it painfully clear that businesses need to hasten their efforts to develop contactless, pervasive (as in anytime and anywhere), and highly resilient extensions to their core offerings and operations so their customers, partners, and employees can feel safe. These extensions, which were otherwise ‘optional’ digital channels for added growth and efficiencies, have now become ‘must haves’ in the post-COVID-19 world.

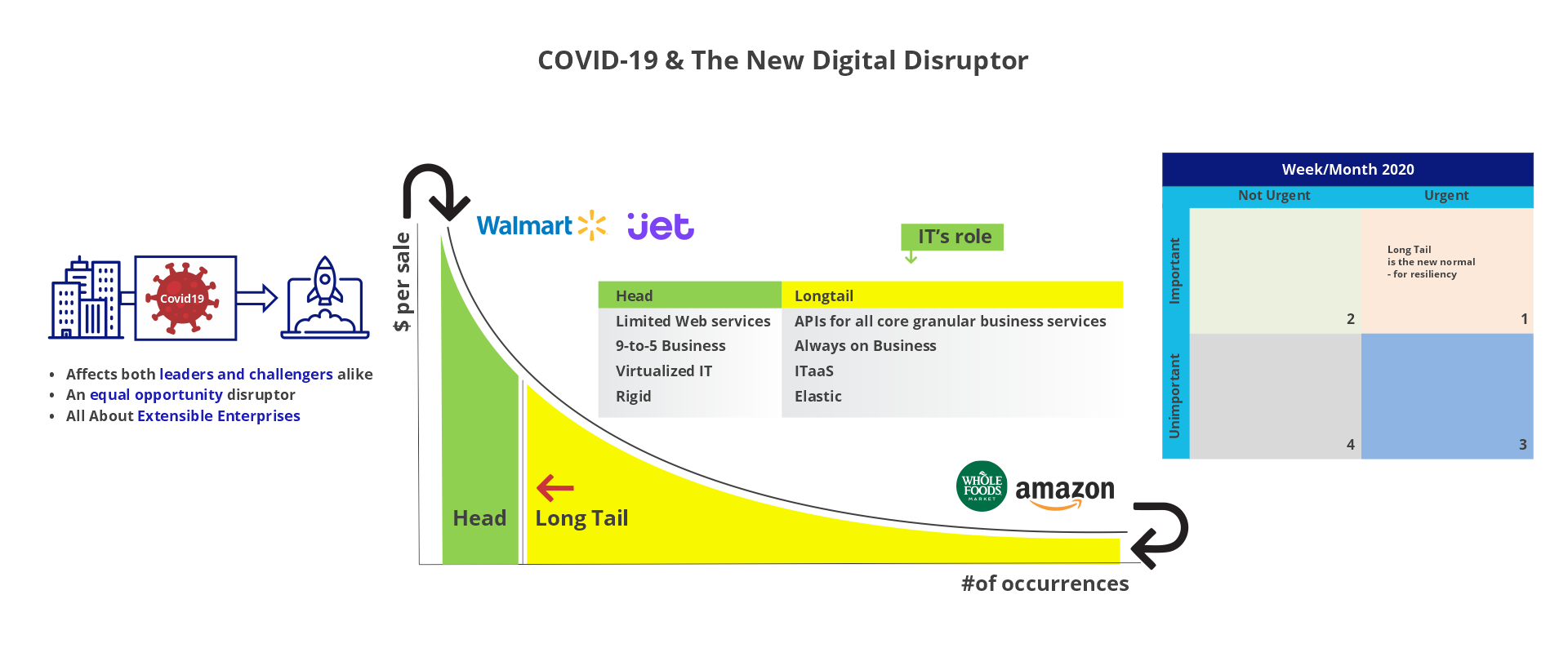

To further illustrate this impact, let us look at the dynamics of digital transformation through the lens of Chris Anderson’s long tail.

Anderson (author, entrepreneur) first articulated the long tail pattern in an article in his ‘Wired’ magazine back in October 2004. The idea became so popular that in 2006 it came out as a full-fledged book called ‘The Long Tail: Why the Future of Business is Selling Less of More’.

When it was first introduced, the long tail was used to effectively explain the strategy and success of online retailers like Amazon.com. But over the years, we find that the same concepts apply equally well, and more assertively so, to understand digital transformations that are shaping the future of traditional businesses across all vertical industries over the last decade, and now in the post-COVID-19 world.

Anderson’s coinage refers to the whole concept of demand distribution over a larger demographic. And, it happens to be a use case that has been studied for many decades by statisticians. The delivery and operational costs of applicable goods/services allow businesses to realize significant profits out of selling sustained lower volumes to many customers instead of only selling larger volumes to a select audience, creating the long tail of their expansion. We must note that the possibilities for this expansion grew even more dramatically with the technological enablers that the latest and greatest in digital technologies have to offer.

Per Anderson’s analysis, there are certain physical constraints that all bricks & mortar businesses face – limited reach and expensive facilities resulting in higher operational costs. It is not easy for them to support a dual ‘products and services’ portfolio. Many of them don’t even have a services portfolio. For those who do, can’t sell services that enjoy a sustained and prolonged demand at a lower price point. Newer business models, which focus more on services, such as those of Amazon.com (retail), Uber/Lyft (transportation), and Lending Tree/Square (Banking and Financial Services) are not faced with these physical constraints. They can create a virtual and highly extensible enterprise that can aim to deliver services to anyone, anywhere, and anytime. Thus, they are able to cater to the long tail effectively.

Digital Transformation and Long Tail Revenue

Digital Transformation and Long Tail Revenue

Looking at the graph in Figure 1 below, we can clearly understand how what we refer to as ‘Digital Transformation (DX)’ is all about traditional businesses identifying newer services, channels, and methods of richer customer experiences to first create and then try to maximize their own long-tail revenue (represented by the area in yellow), while they try to fiercely protect their traditional sources of revenue, (represented by the area in green).

They also try to boost these efforts by acquiring smaller digital companies that can give them a jumpstart in adding such digital capabilities. In the post-COVID-19 world, these capabilities have also become extremely critical for such businesses in staying connected and being there with their customers, partners, and employees. For example, in the essential retail industry, companies that had mobile extensions to offer order placement and delivery to door (through partners such as Instacart) or through their contactless pick-up locations were not only able to ride through the crisis but were also able to make a significant positive impact on the safety of their customers and employees.

On the other end of the spectrum, many of the ‘born digital’ enterprises, aka the digital predators, are now working hard to complement their dominant position in the long tail with a growing footprint of physical capabilities, including manufacturing of products in some cases, to go after the ‘head’ portion of the graph. Hence, it is quite clear that this game of one-upmanship will eventually be an equal opportunity play, for any aspiring business, regardless of which end of the spectrum they start their land grab from, to go after the combined area represented by green and yellow in the graph.

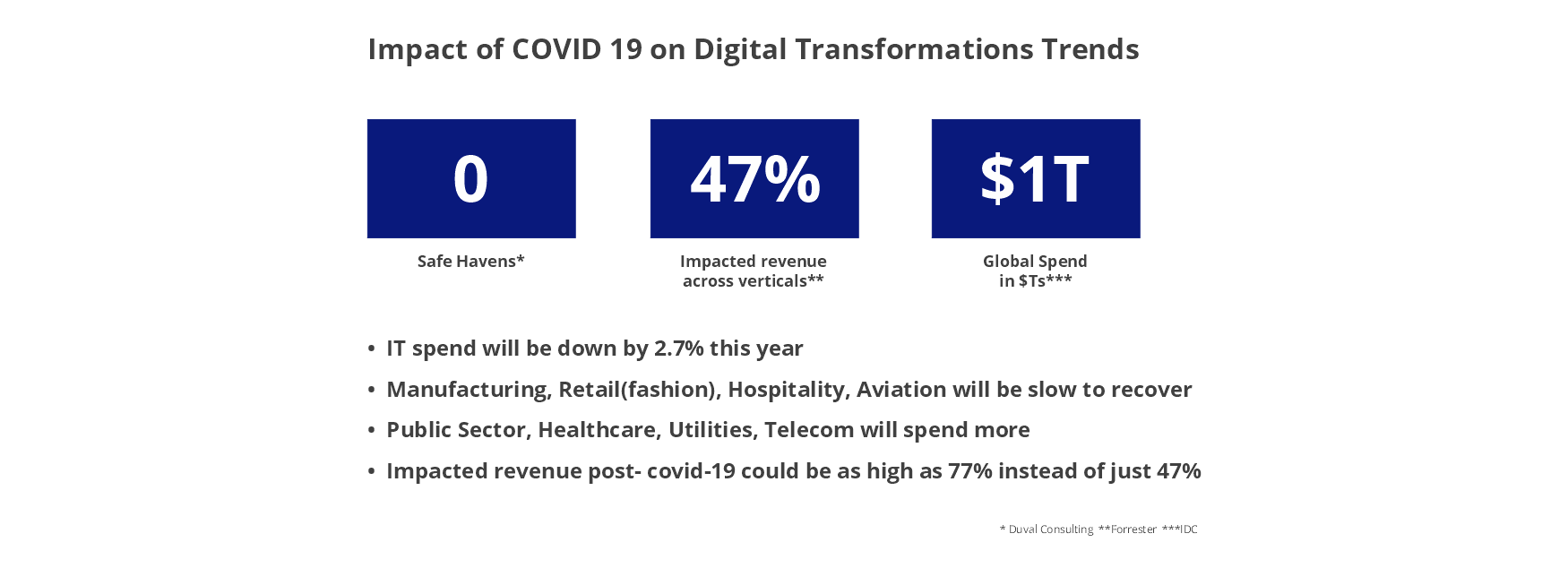

True! It is this battle for land grab that explains why a lot of money is being spent on digital transformations by established enterprises, aka the digital preys, today. This amount, which was initially estimated to be a staggering $1 Trillion globally (figure 2), has now been revised to seven times that in the post-COVID scenario. The barbarians at the gate (the line dividing the green and yellow areas), now include COVID-19 in addition to all the digital predators. It has been estimated, by Forrester, that traditional businesses would risk losing at least 47% of their revenue to their predators and in some cases even totally be wiped out, as was the case with Borders, Blockbuster, Sears, and so on. What is scarier is that the revenue at stake is now being re-estimated at 77% after COVID-19.

A few more observations about certain digital dynamics that the long tail graph helps us call out are as follows:

The area under the long tail can be significantly greater than that of the ‘head’, and can therefore make these new-age companies succeed in ways that are currently not tenable for traditional enterprises (unless they are willing to work hard to digitally transform themselves, and fast). For example, Uber and Lyft combined can make more money-selling tens of millions of rides, for an average of $20-30 on any given day with double-digit profit percentages, than the combined sales of all auto OEMs selling only tens of thousands of new vehicles for an average of $29,000 with low single-digit profit percentages. That is if the OEMs limit their business models to just making vehicles and not push themselves to enter the ‘services’ business that the long tail is all about. This new game of ‘products and services’, one can argue, is actually quite easy for established companies to respond to through digital transformations. On the flip side, it will take more time, money, and acquired capabilities for the digital challengers to add ‘products and manufacturing’ capabilities to their services-rich portfolio to compete in the ‘head’ portion of the graph. The point is, with agile and effective digital transformations, traditional businesses do have a rare opportunity to gain an edge in this land grab. Although companies like Amazon have proven to be the rare exceptions – despite being digital-born, it is threatening its traditional counterparts in the game of market dominance.

This brings us to the point that for traditional businesses, being slow to react can be rather disastrous, more so in the post-COIVID-19 times. What we need to underscore here is that a particular service (such as selling books in a store, or watching a movie in a theater) may get so well entrenched in the long tail area, after disruptions set in and newer buying and user experience habits reach a certain level of maturity, that it will force all providers to either learn the dynamics of the long tail or perish – as it happened with Borders and is now happening to theater chains. We all can take our own guesses as to what will be such a broad-based such use case next? Buying automobiles from OEMs/dealers? What if using ride-sharing in autonomous vehicles becomes the norm for personal transportation needs, for the most part? What if, as Tesla is proposing, our own vehicles, which statistically sit idle for 95% of the time (either at home in the garage or in the parking lot at work) can make money for us by participating in the autonomous ride-sharing gig economy during idle time? Who will be wiped out if that were to happen?

Well, we must also note that many services do coexist in the ‘head’ and the long tail, complementing each other, forcing the providers to have a dual strategy to cater to these two different models. Take for example, BestBuy and Walmart with their stores plus eCommerce strategy with acquisitions like Jet.com by Walmart). They have been so effective at it that while, on the one hand, they are being challenged by the mighty Amazon.com they are also able to return the favor by forcing it to develop a physical presence with moves as the acquisition of WholeFoods. The same applies to many auto OEMs who have transportation-as-a-service offerings of varying flavors. However, they are all in their infancy compared to the challenges and responses in the retail industry.

Given these dynamics, and all the lessons we are learning from COVID-19-induced market scenarios, the established players owe it themselves to get their act together, and to do so rapidly. If they are to stay in the game, they must differentiate themselves as attractive Digital Plus businesses, with balanced portfolios of products and services and robust omnichannel capabilities, that can operate as extensible enterprises of global scale.

But, while traditional businesses may have the capabilities to address both the ‘head’ and long tail portions of their revenue, they do have some big baggage, unlike their challengers. The baggage of older systems (i.e. stodgy applications) and on-prem-only infrastructures can impede these businesses from going where they want to go and how fast. And, it is towards addressing this risk factor that the $1 – $7 Trillion will go.

Key Areas of Digital Transformation to Focus on in the Post-COVID Era

Key Areas of Digital Transformation to Focus on in the Post-COVID Era

In essence, COVID-19 is forcing traditional businesses to focus on the following types of digital transformation efforts as it underscores the need for these enterprises to be more resilient, extensible, automated, and adaptive.

1. Resiliency

A resilient business should be able to operate uninterrupted, staying impervious to disasters like COVID-19 while continuing to offer secure access to its core business systems. That is precisely what regulatory requirements such as a robust Business Continuity / Disaster Recovery (BC/DR) have always insisted on. The initiatives that COVID-19 is pushing traditional businesses to consider in this regard are:

- Cloud-First initiatives which start with a simple lift and shift of core systems (Cloud 1.0) and increasingly include more advanced cloud-native applications involving containerized applications that can run dynamically in multi and distributed cloud environments (Cloud 2.0). These applications constitute the strategic portfolio of a traditional business, helping it cater to the ‘green’ portion of the long tail curve. Most of them may even include mainframe legacy applications that now need to be refactored using Micro-Services Architecture (MSA) to enable them to run on hybrid-cloud infrastructures.

- Decommissioning of non-strategic, i.e. utility, business functions that are better off being supported by a diverse set of SaaS applications, which can offer the dual advantage of greater resiliency and access to a rich set of co-innovated vertical and/or horizontal features. Likewise, more high-end transactional systems of record, i.e. ERPs, are now candidates for CloudERP offerings which are in various stages of maturity, combining mission-critical operational support with resiliency and availability – with much higher SLAs of uptime than private data centers.

But, there is no resiliency without the adequate and heightened level of security that the new normal of ‘zero trust’ demands. While zero trust security architectures have been around for the last 10 years, COVID-19 is now raising the bar on the good old principles of “never trust, always verify”. Zero trust is designed to protect planned digital transformations by leveraging network segmentation, preventing lateral movement, providing threat prevention, and simplifying granular user-access control in the resulting ‘uber-hybrid’ environments.

2. Extensibility

Extensibility has always been the core tenet of digital transformation around which traditional businesses have been building B2C and B2B omni-channels and e-Market places for greater reach to realize the growth benefits that fit into the ‘yellow’ portion of the long tail curve. But with COVID-19, the roll out of next-gen video collaboration infrastructures, or in other words affordable and highly-scalable tele-presence tools with such technologies as Microsoft’s TEAMS and fast/secure VPNs, in conjunction with cloud-based email and office productivity tools, have become a new requirement.

Likewise, hastening efforts to participate in the API economy, with microservices, and API gateways have also become an agenda of greater priority. The same applies to mobile application development efforts that can extend core and relevant business functions from bricks to clicks. These mobile solutions in turn will also need the API infrastructures and RESTful microservices to be in place. Social extensions to such channels as Facebook, Twitter, and YouTube to name a few have long been necessary (as opposed to being deemed frivolous), and have only become more critical now. As we get ready to ‘return to office’ in the next few weeks and months, these extensions will play a greater role in disseminating best practices related to employee and customer safety, in addition to supporting activities related to commerce and marketing.

For traditional businesses with sizable footprints of branch offices, COVID-19 is elevating the priorities around upgrades to WAN infrastructures so they can evolve into being more resilient, scalable, dynamic, and touchless, i.e., very software-defined with SD-WANs and SD-Branches.

3. Automation

One of the prevalent and powerful lessons learned from the pandemic is the realization that antiquated manual business processes are hurting employee safety in addition to creating inefficiencies and wastage. These functions force workers to come to an office when they can easily be delivered from home while avoiding long commutes and wasted time away from work and family. Whether we call it robotic process automation (RPA), machine learning (ML), or the hybrid of both that many now refer to as intelligent automation (IA), there is a great opportunity to start scaling up investments in advanced automation technologies to augment, repurpose, and challenge the capacity of the constrained workforce with the productivity that can be brought to bear. This means extending eSignatures, RPA, ML, and IA from their centers of excellence and related PoCs to more broadly throughout the enterprise.

4. Adaptability

As with our general personal and public lives, IT’s adaptability is undergoing heavy-duty testing by the pandemic. To come out with a passing grade, we need systems that are not built to last but are instead crafted to be adaptable. Traditional enterprises need an end-to-end DX methodology that combines both business transformation and technology enablement. This methodology must also have an underlying foundation layer of agile software development methods, to ensure they can not only be digital, but also stay digital.

That is where best practices related to implementing the ‘continuous next’ through DevSecOps and Continuous Development (CD) and Continuous Integration (CI) come in. Contrary to prevalent beliefs that the incorporation of DevSecOps methods can only help Fast IT (IT of Startups and Digital Predators), digital transformations at traditional businesses prove that DevSecOps is indeed necessary to build a bridge across the two worlds of IT.

Conclusion

Conclusion

While COVID-19 is definitely accelerating the initiatives listed above, focus on being more data-driven and being more vested in self-service platforms will continue to dominate the IT agenda going forward.

As for self-service systems, there’s no better time to start front-ending these systems with some AI and bots. Advanced intelligent self-service channels and platforms will help employees, customers, and partners get what they need with less hand-holding and contact (interactions that COVID-19 precautions recommend us to avoid) from IT and business.

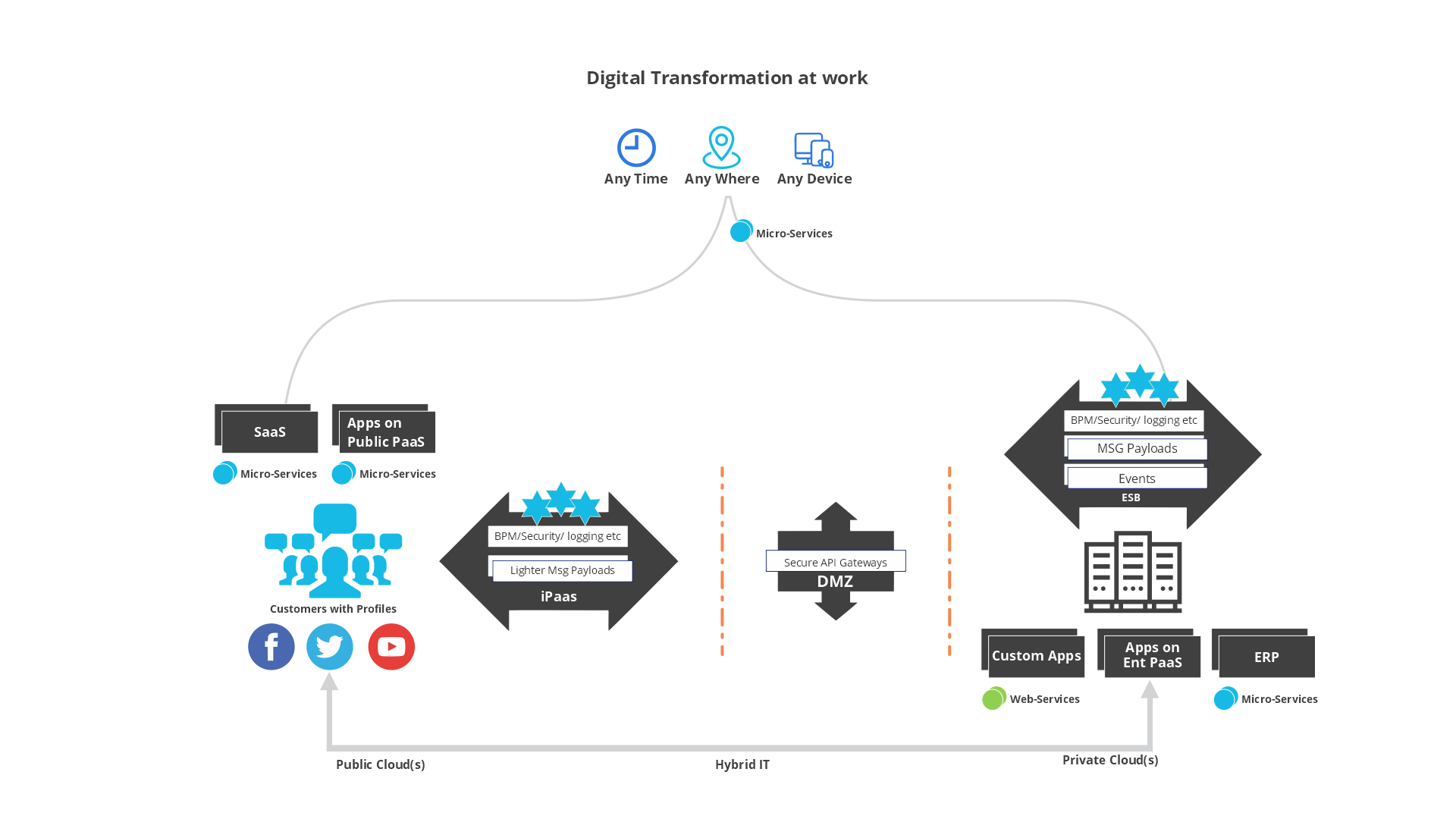

So, if we put it all together, the dynamic run-time world of the new digital enterprise, that is smarter from COVID-19, will continue to look like what we have been depicting for a while in these columns, as shown in Figure 3, only the pace of change will be much faster. There will be micro-services across the hybrid boundaries of clouds owned and/or subscribed to by the enterprise, all securely interacting with each other – to tap into, reach out to, and serve customers, many orders of magnitude higher than what traditional businesses have been used to so far, with more and more employees working remotely as appropriate.

Contributor

Sreedhar Kajeepeta

Chief Technology Officer

About Innova Solutions

Innova Solutions is a leading global information technology services and consulting organization with 30,000+ employees and has been serving businesses across industries since 1998. A trusted partner to both mid-market and Fortune 500 clients globally, Innova Solutions has been instrumental in each of their unique digital transformation journeys. Our extensive industry-specific expertise and passion for innovation have helped clients envision, build, scale, and run their businesses more efficiently.

We have a proven track record of developing large and complex software and technology solutions for Fortune 500 clients across industries such as Retail, Healthcare & Lifesciences, Manufacturing, Financial Services, Telecom and more. We enable our customers to achieve a digital competitive advantage through flexible and global delivery models, agile methodologies, and battle-proven frameworks. Headquartered in Duluth, GA, and with several locations across North America, Europe, Latin America and the Asia-Pacific regions, Innova Solutions specializes in 360-degree digital transformation and IT consulting services.

For more information, please reach us at – [email protected]